Pin on Weaving - Source www.pinterest.com

To assist our target audience, we've conducted extensive research and consulted with industry experts to provide a comprehensive guide on "Gold Prices Take A Tumble: Market Update." This guide aims to empower investors of all levels to navigate the complex world of gold investing, understand the underlying factors influencing price movements, and make informed decisions about their portfolios.

| Feature | Gold Prices Take A Tumble: Market Update |

|---|---|

Transition to main article topics:

FAQ

This comprehensive FAQ section provides answers to frequently asked questions regarding the recent decline in Gold Prices.

Thailand gold prices take a slight tumble | Thaiger - Source thethaiger.com

Question 1: What factors contributed to the decrease in gold prices?

The recent dip in gold prices can be attributed to a combination of factors, including rising interest rates, a strengthening US dollar, and decreased demand for safe-haven assets.

Question 2: How significantly have gold prices fallen?

The price of gold has experienced a noticeable decline, dropping from its peak of approximately $2,000 per ounce to its current level around $1,800 per ounce.

Question 3: Will gold prices continue to decline in the future?

The future trajectory of gold prices is subject to market fluctuations and economic conditions. While predicting precise future prices is challenging, analysts provide varying perspectives on the potential direction of gold prices.

Question 4: Should I sell my gold holdings now?

The decision to buy or sell gold depends on individual investment strategies and risk tolerance. Investors should consider their financial situation, investment goals, and market outlook before making any significant investment decisions.

Question 5: Is this an opportune time to invest in gold?

The current price dip could present an opportunity for investors interested in acquiring gold at a potentially favorable price. However, it is crucial to conduct thorough research and consult with financial advisors before making investment decisions.

Question 6: What are the potential implications of the gold price decline for the economy and investors?

The decline in gold prices can have repercussions for the economy and investors. It may indicate a shift in investor sentiment, impact the performance of gold-related stocks and ETFs, and potentially influence the overall market.

By addressing these frequently asked questions, we aim to provide a comprehensive overview of the recent gold price decline and its potential implications.

Stay informed on the latest market developments by exploring Gold Prices Take A Tumble: Market Update for in-depth analysis and expert insights.

Tips

Recent market volatility has led to a significant decline in gold prices. While this may be a cause for concern for some investors, it also presents an opportunity to reassess their investment strategies. Consider these tips to navigate the current market landscape effectively:

Tip 1: Rebalance Portfolio:

Review your portfolio allocation and consider rebalancing to maintain a diversified portfolio. Reduce exposure to gold if it has become disproportionately large due to recent price fluctuations.

Tip 2: Buy on Dips:

The price drop may offer an opportunity to acquire gold at a more favorable price. Consider purchasing small amounts of gold as prices fluctuate, utilizing the dollar-cost averaging strategy.

Tip 3: Consider Gold Stocks:

Gold mining companies can benefit from lower gold prices, as they can increase production margins. Consider investing in reputable gold stocks to potentially mitigate the impact of falling gold prices.

Tip 4: Explore Alternative Investments:

Diversify your investments by exploring other precious metals, such as silver or platinum, or other asset classes, such as real estate or bonds. This can help reduce risk and potentially increase returns.

Tip 5: Seek Professional Advice:

Consult with a financial advisor to discuss your investment goals and risk tolerance. They can provide personalized recommendations based on your unique situation.

Tip 6: Understand Market Cycles:

Recognize that market cycles are inevitable. While gold prices have experienced a decline, they have historically rebounded over the long term. Maintain a long-term perspective and avoid making impulsive decisions.

Summary:

The decline in gold prices presents both challenges and opportunities. By adopting a strategic approach and considering these tips, investors can navigate the market effectively and potentially enhance their investment returns in the long run.

Gold Prices Take A Tumble: Market Update

Gold has long been a haven for investors during times of uncertainty, but a recent market update suggests that gold prices have been taking a tumble. Here are six key aspects to consider:

Global Views Small Gold Leaf Tumble Weed Sculpture | Neiman Marcus - Source www.neimanmarcus.com

- Inflation: Rising inflation reduces the value of gold.

- Interest Rates: Higher interest rates make gold less attractive.

- Dollar Strength: A stronger dollar devalues gold.

- Central Bank Sales: Gold sales by central banks can suppress prices.

- Demand from Jewelry: Decreased demand from jewelry makers can lower prices.

- Economic Outlook: A positive economic outlook reduces the need for safe havens like gold.

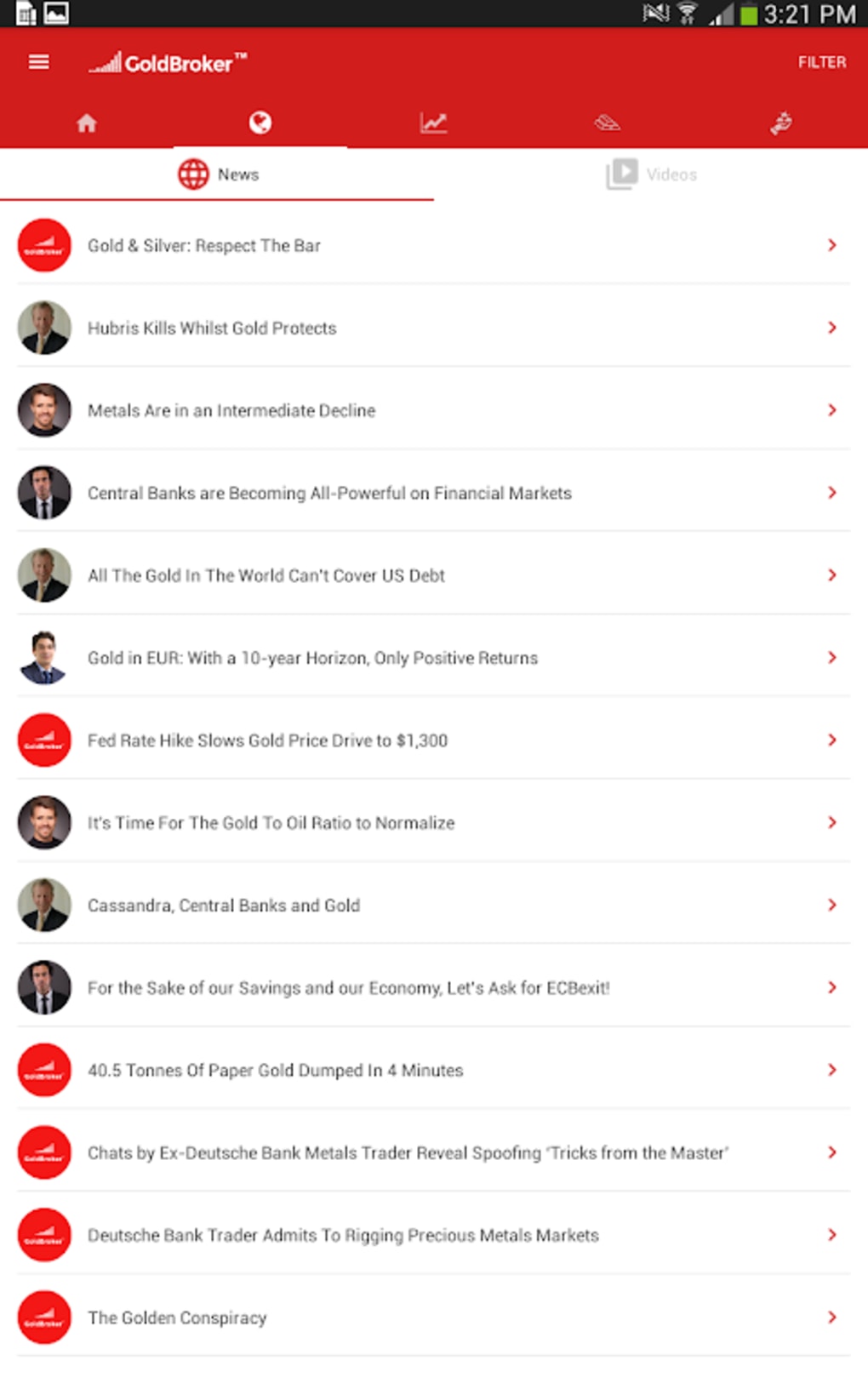

Gold and Silver Prices, Charts, Market News APK for Android - Download - Source gold-and-silver-prices-charts-market-news.en.softonic.com

These factors have contributed to the recent decline in gold prices, highlighting the influence of macroeconomic conditions, market dynamics, and central bank actions on the precious metal's valuation. Understanding these aspects is crucial for investors to make informed decisions regarding gold investments.

Gold Prices Take A Tumble: Market Update

The recent decline in gold prices has been attributed to a combination of factors, including rising interest rates, a strengthening US dollar, and geopolitical uncertainty. Higher interest rates make gold less attractive to investors seeking yield, while a stronger dollar makes it more expensive for buyers holding other currencies. Additionally, geopolitical tensions, such as the ongoing conflict in Ukraine, have led to increased demand for safe-haven assets like the US dollar, putting further pressure on gold prices.

Lumber Prices Tumble to Three-Year Low as Futures Market Transformation - Source www.mcalindenresearchpartners.com

The decline in gold prices has significant implications for investors and the broader economy. For investors, it represents a potential loss of value for those who have purchased gold as a safe-haven asset or as a hedge against inflation. Meanwhile, for the economy, lower gold prices could lead to reduced investment in gold mining and exploration, potentially impacting employment and economic growth in gold-producing regions.

Understanding the connection between the factors influencing gold prices and their impact on different stakeholders is crucial for informed decision-making. By considering these factors, investors can make appropriate adjustments to their portfolios, while policymakers can develop strategies to mitigate the potential economic consequences of gold price fluctuations.

Conclusion

The recent decline in gold prices underscores the complex interplay of economic and geopolitical factors that shape the value of precious metals. As interest rates and geopolitical tensions continue to evolve, it is essential for investors and policymakers to monitor the gold market closely.

By understanding the drivers of gold price fluctuations, investors can make informed decisions about their gold holdings, while policymakers can implement measures to mitigate the potential economic consequences of gold price volatility.