“Current Currency Exchange Rates: Find The Best Rates For Your Transactions”

Editor's Notes: "Current Currency Exchange Rates: Find The Best Rates For Your Transactions" have published today date".

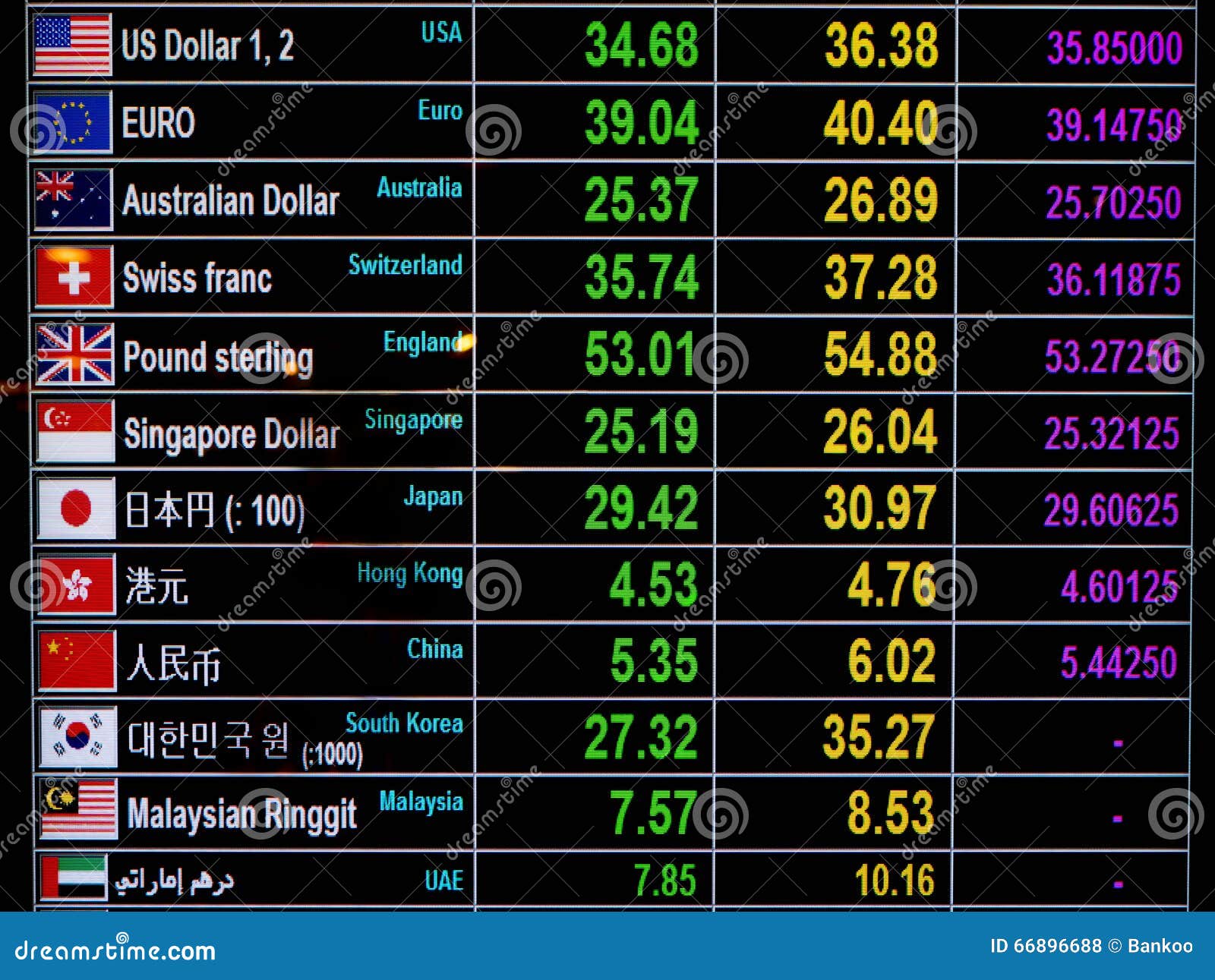

It's important to be aware of the current currency exchange rates when you're traveling or doing business internationally. The exchange rate is the value of one currency in relation to another. It can fluctuate frequently, so it's important to check the latest rates before you make a transaction.

If you're not careful, you could end up paying more than you need to. Our effort in doing some analysis, digging information, made Current Currency Exchange Rates: Find The Best Rates For Your Transactions we put together this Current Currency Exchange Rates: Find The Best Rates For Your Transactions guide to help target audience make the right decision.

There are many online tools you can use to check currency exchange rates. These tools can help you compare rates from different banks and money transfer services to find the best deal.

Currency Exchange: Should You Exchange at Home or Abroad? - Source www.atlmoney.com

Here are some tips for finding the best currency exchange rates:

- Do your research. Get the information about Currency Exchange Rates: Find The Best Rates For Your Transactions read expert opinion, and compare rates from different providers. The more you know, the better equipped you'll be to find the best deal.

- Shop around. Don't just stick with the first bank or money transfer service you find. Take the time to compare rates from multiple providers before you make a decision.

- Use a currency converter. This can help you quickly and easily compare rates from different banks and money transfer services.

- Be aware of hidden fees. Some banks and money transfer services charge hidden fees that can eat into your savings. Be sure to read the fine print before you make a transaction.

- Lock in your rate. If you're traveling to a country with a volatile currency, you may want to lock in your exchange rate ahead of time. This will guarantee that you get the best possible rate, even if the rate fluctuates while you're away.

- Market Fluctuations: Exchange rates are constantly fluctuating due to economic, political, and market forces.

- Transaction Fees: Banks and currency exchange services often charge fees for currency conversions.

- Convenience: Accessibility to exchange services, including online platforms and physical locations, is essential.

- Exchange Rates: Comparing rates from multiple providers ensures you get the most favorable terms.

- Transaction Security: Ensure the security of your financial information and transactions.

- Expert Advice: Consult with currency experts to navigate complex exchange markets effectively.

FAQ

Currency exchange rates fluctuate constantly, impacting the value of our money when traveling, shopping, or investing abroad. Understanding how these rates work can help save money and plan financial transactions more effectively.

Digital Currency Exchange Rates Here You Will Find Our Full List Of The - Source cryptocurrencyexchangerates1.blogspot.com

Question 1: What factors influence currency exchange rates?

Exchange rates are determined by supply and demand for currencies, influenced by factors such as economic growth, interest rates, inflation, political stability, and global economic conditions.

Question 2: How can I find the best exchange rates?

Compare rates from multiple sources like banks, currency exchange services, and online platforms. Check Current Currency Exchange Rates to find the most favorable rates.

Question 3: Are there fees involved in currency exchange?

Yes, most providers charge fees or mark up the exchange rate. These fees vary depending on the amount exchanged and the service used.

Question 4: What is the difference between a spot rate and a forward rate?

The spot rate is the current exchange rate, while the forward rate is an agreed-upon exchange rate for a future date.

Question 5: How can exchange rate fluctuations impact my travel plans?

Fluctuating exchange rates can affect the cost of travel, making it more or less expensive to visit certain destinations.

Question 6: How can businesses mitigate currency exchange risks?

Businesses can use hedging strategies, such as forward contracts or currency options, to manage the risks associated with exchange rate fluctuations.

Understanding currency exchange rates empowers individuals and businesses to make informed decisions when transferring money or conducting cross-border transactions.

To stay updated on the latest currency exchange rates and market trends, visit Current Currency Exchange Rates.

Tips for Getting the Best Currency Exchange Rates

Obtaining the most favorable exchange rates is crucial when dealing with international transactions. Here are a few practical tips to assist you in securing the best rates:

Current Exchange Rates Dollar To Euro – Currency Exchange Rates - Source www.qarya.org

Tip 1: Compare Exchange Rates Across Multiple Providers

Do not limit yourself to a single currency exchange provider. Compare exchange rates offered by various banks, online platforms, and specialized foreign exchange brokers to find the most competitive rates.

Tip 2: Be Aware of Currency Fluctuations

Exchange rates are constantly fluctuating. Monitor currency trends and exchange rate forecasts to identify the most opportune time to make a currency exchange. Consider using a rate-tracking tool to stay informed of real-time fluctuations.

Tip 3: Consider Using Mid-Market Rates

The mid-market rate is the midpoint between the buy and sell rates quoted by currency providers. Avoid exchange rates that deviate significantly from the mid-market rate, as these often include hidden fees or commissions.

Tip 4: Negotiate with Currency Providers

For large currency exchanges, do not hesitate to contact currency providers directly and negotiate a better exchange rate. Explain your transaction details and inquire about any available discounts or preferential rates.

Tip 5: Utilize Market Orders or Limit Orders

Market orders execute trades at the current market rate, while limit orders allow you to specify a desired exchange rate and wait for it to be met. Utilize limit orders if you anticipate favorable rate fluctuations in the future.

Tip 6: Be Vigilant of Hidden Fees

Some currency providers may charge additional fees, such as transaction fees, wire transfer fees, or service charges. Read the terms and conditions carefully to avoid unexpected expenses.

By following these tips, you can increase your chances of securing the best currency exchange rates for your international transactions, saving you money and maximizing the value of your foreign exchange.

Remember that exchange rates can change rapidly, so staying informed and being flexible in your approach will help you make the most of your currency exchanges.

Current Currency Exchange Rates: Find The Best Rates For Your Transactions

In today's globalized economy, understanding currency exchange rates is crucial for businesses and individuals alike. Here are six key aspects to consider when seeking the best rates for your transactions:

By understanding these key aspects, you can make informed decisions when exchanging currencies, saving money and mitigating risks. Staying up-to-date on market fluctuations, selecting providers with competitive rates and low fees, and seeking professional guidance when necessary are all essential practices in the world of currency exchange. For instance, if you are traveling to a foreign country, comparing exchange rates at different banks and online platforms can save you a significant amount on your currency conversion.

Current Currency Exchange Rates: Find The Best Rates For Your Transactions

Currency exchange rates are crucial for global commerce and financial transactions. They establish the value of one currency relative to another, influencing the cost of goods and services traded internationally. Monitoring and understanding current exchange rates is vital for businesses and individuals seeking the best deals when exchanging currencies.

How to exchange currency without paying big fees? - Source www.usatoday.com

Factors that affect currency exchange rates include economic conditions, interest rates, inflation, political stability, and supply and demand. For example, a country with a strong economy and stable government may experience a higher demand for its currency, leading to an appreciation in its value. Conversely, a country facing economic challenges may see its currency depreciate against others.

Businesses can optimize their foreign exchange transactions by staying up-to-date with exchange rates and utilizing tools like currency hedging to minimize risks. Individuals traveling or making international purchases can also benefit from comparing rates from different providers and choosing the most favorable exchange rate available.

In conclusion, understanding current currency exchange rates is crucial for navigating the global financial landscape. By monitoring rates and considering market factors, businesses and individuals can make informed decisions to maximize their returns and minimize costs in international transactions.