What are the Benefits and Coverage of PhilHealth?

PhilHealth to roll out expanded benefits for members | Philippines - Source headtopics.com

Editor’s Note: Healthcare is one of life’s most important aspects. Find out the rights and benefits you have as a member of PhilHealth.

We took the liberty of analyzing and digging through information to come up with this comprehensive guide to help you understand your PhilHealth benefits and coverage. Read on to make informed decisions about your healthcare.

FAQ

This FAQ section provides succinct answers to frequently asked questions regarding PhilHealth benefits and coverage. By addressing common concerns and clarifying misconceptions, it serves as a valuable resource for members seeking comprehensive information about their health insurance protection. Benefits And Coverage Of PhilHealth: A Comprehensive Guide For Members

Question 1: What is the PhilHealth Lifetime Member (PLM) Program and who is eligible?

The PLM Program is designed to provide lifetime coverage for members who have reached the age of 60 years old and have at least 120 monthly contributions. To qualify, individuals must have been active PhilHealth members for at least 10 years and have no outstanding contributions.

Question 2: Are there any illnesses or procedures that are not covered by PhilHealth?

While PhilHealth provides comprehensive coverage, certain illnesses and procedures may not be covered under the program. These include cosmetic surgeries, dental services, and non-essential treatments such as acupuncture and massage therapy.

Question 3: What is the process for filing a PhilHealth claim?

To file a PhilHealth claim, members must submit the necessary documents, including the PhilHealth Member Data Record (MDR), hospital bill, doctor's certification, and other relevant medical records, to the accredited hospital or health care provider where they received treatment.

Question 4: Are there any penalties for late payment of PhilHealth contributions?

Members who fail to pay their PhilHealth contributions on time may be subject to penalties, including surcharges and interest on the unpaid amount. To avoid penalties, it is crucial to make regular and timely contributions.

Question 5: What are the benefits of availing PhilHealth services?

By utilizing PhilHealth services, members can access a wide range of health care benefits, including inpatient and outpatient care, laboratory tests, diagnostic procedures, and surgeries. This comprehensive coverage provides financial assistance and ensures access to essential health care services.

Question 6: How can I update my PhilHealth records or change my personal information?

Members can update their PhilHealth records and change their personal information by visiting the nearest PhilHealth branch or by submitting a request online through the PhilHealth website or mobile application.

Summary: Understanding PhilHealth benefits and coverage is essential for members to maximize their health insurance protection. By addressing common questions and concerns, this FAQ section provides valuable information to ensure that members are well-informed about the program and can access the health care services they need.

For more detailed information on PhilHealth benefits and coverage, please visit the official PhilHealth website or consult with a PhilHealth representative.

Tips for Maximizing PhilHealth Coverage

PhilHealth membership provides access to a range of healthcare benefits, including hospitalization, outpatient services, medicines, and even maternity care. To optimize your coverage, consider these valuable tips:

Tip 1: Familiarize Yourself with PhilHealth's Benefits Package

Thoroughly review the PhilHealth website or consult with a PhilHealth representative to gain a comprehensive understanding of the covered medical services and their corresponding benefit rates. This knowledge empowers you to make informed decisions regarding your healthcare utilization.

Tip 2: Maintain Regular Premium Payments

Consistent premium payments are crucial for maintaining active PhilHealth coverage. Delinquent payments can result in the suspension of benefits, creating potential financial burdens in the event of medical emergencies. Explore flexible payment options and consider automatic deductions to ensure timely payments.

Tip 3: Coordinate with Accredited Healthcare Providers

PhilHealth has a network of accredited healthcare providers that offer covered services. Prioritize these providers for your medical care to avoid out-of-pocket expenses. Obtain a PhilHealth referral for specialist consultations or hospital admissions to ensure reimbursement.

Tip 4: Keep Records of Medical Expenses

Retain receipts, invoices, and medical certificates for all PhilHealth-covered expenses. These documents serve as proof of expenses and are essential for reimbursement claims or appeals.

Tip 5: File Reimbursement Claims Promptly

Submit reimbursement claims within the prescribed timeframe to avoid delays or rejections. Ensure that all required documents are attached, and provide clear and accurate information to facilitate efficient processing.

Tip 6: Utilize PhilHealth's Online Services

PhilHealth's online portal offers convenient access to membership information, benefit inquiries, and claim status updates. Utilize these services to stay informed and proactively address any coverage issues.

Tip 7: Explore Additional Coverage Options

Consider supplementary private health insurance to enhance your coverage and protect against potential gaps in PhilHealth's benefits. Research and compare different plans to find one that aligns with your specific needs.

Understanding and maximizing PhilHealth coverage empowers you to access quality healthcare services without undue financial strain. By incorporating these tips into your healthcare strategy, you can optimize your benefits and protect your health.

Benefits And Coverage Of PhilHealth: A Comprehensive Guide For Members

PhilHealth, the Philippine Health Insurance Corporation, provides a range of benefits and coverage to its members. This guide explores essential aspects to consider for a comprehensive understanding.

- Inclusive Benefits: PhilHealth provides financial assistance for various medical expenses, including hospitalization, outpatient care, and medicines.

- Flexible Coverage: Membership options cater to different income levels and needs, ensuring accessibility for all members.

These aspects are interconnected and vital for members to understand. For instance, flexible coverage allows individuals to choose a plan that aligns with their financial capabilities, ensuring they receive the necessary healthcare services. PhilHealth's inclusive benefits offer comprehensive support, reducing the financial burden of medical expenses and promoting access to quality healthcare.

PhilHealth Benefits for Pregnant Members — A GUIDE | PhilNews - Source philnews.ph

Benefits And Coverage Of PhilHealth: A Comprehensive Guide For Members

PhilHealth, the Philippine Health Insurance Corporation, provides a wide range of benefits and coverage to its members. These benefits include inpatient and outpatient care, as well as a variety of preventive and promotive health services. PhilHealth's coverage is designed to help members access the healthcare services they need, when they need them, without having to worry about the cost.

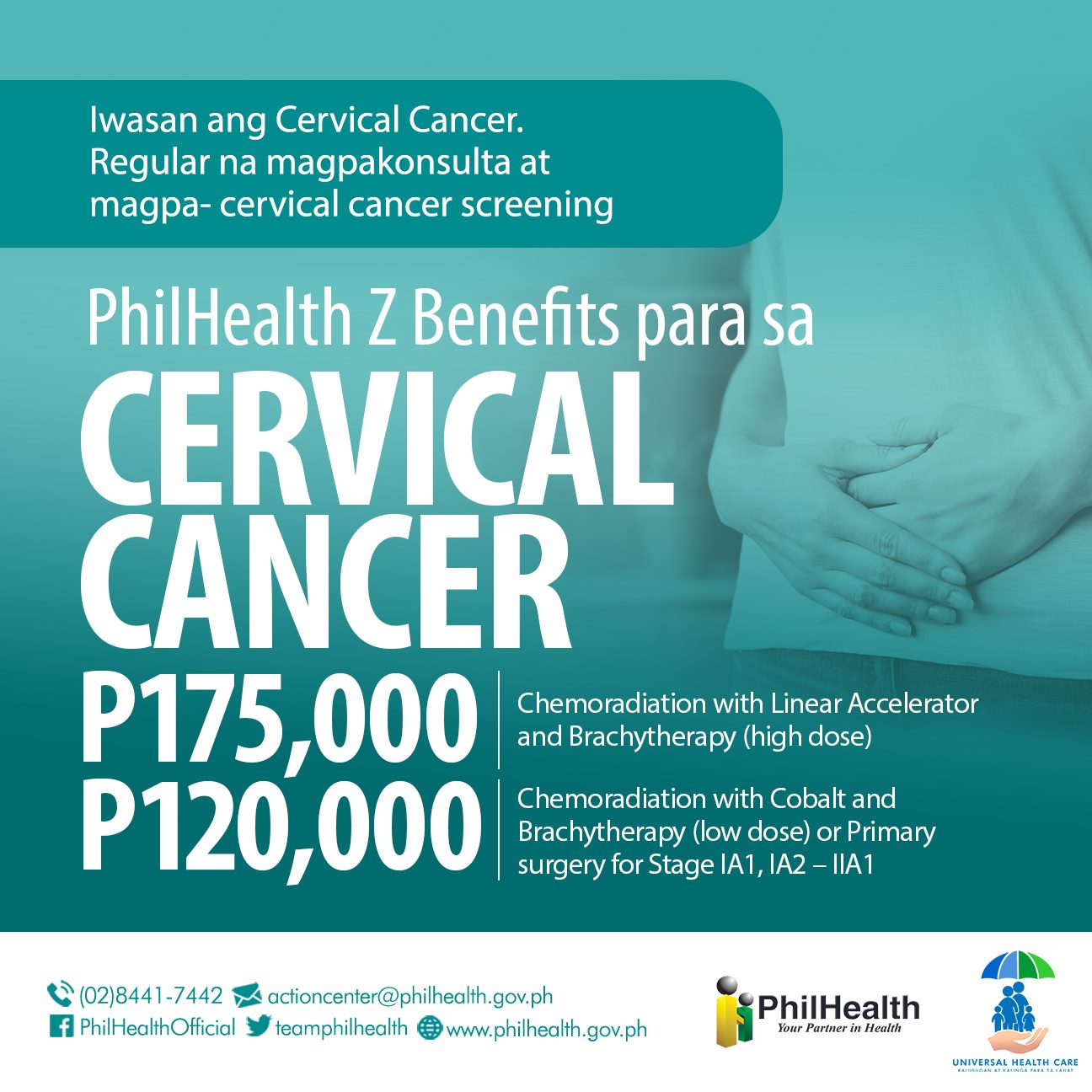

Cervical cancer coverage: A top priority of PhilHealth | Cebu Daily News - Source cebudailynews.inquirer.net

The benefits of PhilHealth coverage are numerous. For example, PhilHealth members can receive free or discounted medical care at government hospitals and clinics. They can also receive subsidies for the cost of prescription drugs, and they can access a variety of preventive and promotive health services, such as screenings, vaccinations, and health education.

PhilHealth coverage is also essential for members who need to access specialized care. For example, PhilHealth covers the cost of cancer treatment, dialysis, and other expensive medical treatments. This coverage can help to ensure that members can get the care they need, regardless of their financial situation.

Table 1: Benefits And Coverage Of PhilHealth

| Benefit | Coverage |

|:---|:---|

| Inpatient care | Room and board, nursing care, and other hospital services |

| Outpatient care | Doctor's visits, laboratory tests, and other outpatient services |

| Preventive and promotive health services | Screenings, vaccinations, and health education |

| Prescription drugs | Subsidies for the cost of prescription drugs |

| Specialized care | Cancer treatment, dialysis, and other expensive medical treatments |

PhilHealth coverage is a valuable benefit for members. It can help them to access the healthcare services they need, when they need them, without having to worry about the cost.

Conclusion

PhilHealth is a valuable asset to the Philippine healthcare system. Its benefits and coverage help to ensure that members can access the healthcare services they need, when they need them, without having to worry about the cost. PhilHealth's commitment to providing affordable and accessible healthcare is essential to the health and well-being of the Filipino people.

However, challenges remain in ensuring that all Filipinos have access to PhilHealth coverage. One challenge is the low PhilHealth contribution rate. The current contribution rate of 3% of monthly income is insufficient to cover the full cost of PhilHealth's benefits and coverage. This low contribution rate has led to a funding gap, which has forced PhilHealth to limit its coverage and increase member premiums.

Another challenge is the informal economy. Many Filipinos work in the informal economy, which means they do not have regular employment and do not have access to PhilHealth coverage. This lack of coverage puts informal workers at risk of financial hardship if they need to access healthcare services.

Despite these challenges, PhilHealth remains an essential part of the Philippine healthcare system. Its benefits and coverage help to ensure that millions of Filipinos have access to the healthcare services they need. With continued support from the government and the Filipino people, PhilHealth can continue to provide affordable and accessible healthcare for all.